December 7, 2023

Choosing the Right Mortgage: Expert Broker Tips

Embarking on the journey to find the perfect mortgage can feel like navigating a maze with countless turns and dead ends. You're not just looking for a loan; you're searching for the right fit for your unique financial situation and future plans.

That's where a mortgage broker comes into play, offering tailored advice and access to a plethora of deals you might not find on your own.

Understanding the nuances of fixed-rate versus variable mortgages, interest-only loans, and the impact of your deposit size can be daunting. In this article, you'll discover how to sift through the jargon and find a mortgage broker who can demystify the process.

Understanding Mortgage Brokers

A mortgage broker is a licensed professional tailored to help you find the ideal mortgage.

They act as a go-between for you and potential lenders. Unlike loan officers who represent the bank offering the mortgage, brokers have access to an array of products and lenders.

They assess your financial situation, understand your needs, and work to find a mortgage deal that fits your circumstances like a glove.

Mortgage brokers hold expertise in:

Evaluating your financial health

Explaining different types of mortgages

Finding rates that may not be advertised to the public

Negotiating terms on your behalf

Streamlining the application process

These professionals offer a bespoke service, ensuring you don’t just take any mortgage but the right one.

Factors to Consider When Choosing a Mortgage Broker

When you're on the hunt for a mortgage broker, several factors come into play that can make or break your borrowing experience. You'll want to weigh these carefully to ensure you're making an informed decision that will benefit your long-term financial health.

1. Reputation and Experience

The reputation and experience of a mortgage broker can't be overstated. A stellar track record of helping clients secure their ideal mortgage speaks volumes about their capabilities.

Look for brokers with positive testimonials and high ratings.

Years in business can indicate a deep understanding of the mortgage landscape.

Check if they have any industry accolades or awards.

Brokers who've weathered various economic cycles can provide insights that go beyond the numbers.

2. Range of Lenders and Mortgage Products

A mortgage broker with access to an extensive range of lenders and mortgage products can offer you more options that align with your financial goals.

Ensure they can tap into a wide network of lenders, including banks, credit unions, and private lenders.

Confirm that they offer a variety of mortgage types, from fixed-rate to adjustable-rate mortgages, so you have the flexibility to choose.

The broader the selection, the better your chances of finding a mortgage that's tailored to your situation.

3. Fees and Charges

Understanding the fee structure of a mortgage broker is essential to avoid any surprises down the line.

Some brokers don't charge you directly as they're compensated by the lenders, but this isn't always the case.

Ask for a clear explanation of all fees and how they'll be paid.

An honest broker will be transparent about whether their compensation might influence their recommendations.

4. Customer Service and Support

The level of customer service and support offered by a mortgage broker can greatly influence your satisfaction.

A good broker should be readily available to answer your questions and guide you through the process.

Look for someone who provides regular updates and demystifies complex jargon into language you can understand.

A dedicated point of contact can be invaluable when you need quick responses.

Quality customer service ensures a smooth process and peace of mind that you're well taken care of.

Types of Mortgages

When you're navigating the mortgage market, it's vital to understand the different types of mortgages available to you. This knowledge ensures you choose a product that aligns with your financial circumstances and goals.

Let's explore the common types of mortgages you might encounter.

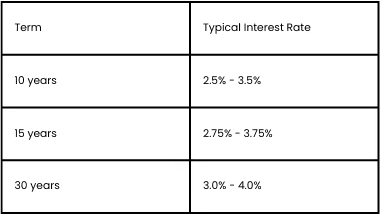

1. Fixed-Rate Mortgages

Fixed-rate mortgages are perhaps the most straightforward mortgage product you'll find. With these mortgages, your interest rate remains constant throughout the term of the loan, which can range from 10 to 30 years.

This predictability means you'll know exactly what your monthly payments will be, making it easier to budget. Fixed-rate mortgages are ideal if you prefer stability and have no plans to move in the near future.

Be aware that the interest rates will vary based on the economic climate and personal financial eligibility.

2. Adjustable-Rate Mortgages

Adjustable-rate mortgages (ARMs), on the other hand, begin with a fixed interest rate for a short introductory period. Following this, your rate will fluctuate with market trends.

ARMs are broken down into hybrid terms, denoted as 5/1, 7/1, or 10/1, where the first number represents the years of fixed rate and the second refers to the adjustment frequency after the initial term.

The main advantage of ARMs is the potential for a lower rate during the fixed period. However, you must be comfortable with the uncertainty that your payments could increase.

This type of mortgage might suit you if you're planning to sell or refinance before the adjustable period begins.

3. Interest-Only Mortgages

Interest-only mortgages allow you to pay just the interest on the loan for a set period, usually 5 to 10 years. During this time, your monthly payments will be lower since you're not reducing the principal balance.

However, once the interest-only term expires, your payments increase significantly as you start paying off the principal.

This option can be useful if you expect your income to rise in the future or if you're investing in property that you plan to sell for a profit before the interest-only period ends. Be cautious, though, as you're not building equity during the interest-only phase.

4. Government-Backed Mortgages

Lastly, there are various government-backed mortgages designed to help specific groups of homebuyers.

These include:

FHA loans for low-to-moderate-income borrowers

VA loans for veterans and service members

USDA loans for rural homebuyers

Government-backed mortgages frequently offer attractive benefits like lower down payments and more flexible credit requirements. FHA loans, for instance, can require as little as 3.5% down, making homeownership more accessible.

It's crucial to weigh the pros and cons of each mortgage type against your unique financial landscape.

Thoroughly research and consider how changes in your circumstances could affect your ability to meet mortgage payments over time. Your mortgage broker can help pinpoint the type that's right for your situation.

Determining the Right Mortgage for You

1. Assessing Your Financial Situation

Before you dive into the vast sea of mortgage options, it's pivotal to take a hard look at your financial health. Assessing your financial situation involves examining your income, expenses, debts, and credit score.

Understanding your monthly cash flow is crucial; it determines how much you can comfortably afford to repay each month. Start by gathering recent pay slips, bank statements, and any other documentation that reflects your current financial status.

Your debt-to-income ratio (DTI) is particularly important to lenders; it's a measure of your monthly debt payments divided by your gross monthly income.

Typically, lenders prefer a DTI that's below 36%, with no more than 28% of that debt going towards servicing a mortgage.

2. Considering Your Long-Term Goals

It's not just about what you can afford now; considering where you see yourself in 5, 10, or 30 years plays a pivotal role in deciding the right mortgage for you. Do you plan on moving frequently, or are you looking for a forever home?

Will there be significant changes in your income over the years? Such questions help pinpoint whether a short-term ARM or a long-term fixed mortgage is more aligned with your goals.

Anticipate life changes such as retirement, children's education, or career shifts that could affect your finances.

3. Seeking Professional Advice

Finally, but far from least, seek out professional guidance. Even with a thorough understanding of your options, a mortgage broker can provide tailored advice that aligns with your unique position.

They have the industry know-how to navigate complex situations and can act as your advocate in finding the best deal. Remember, a good mortgage broker should offer transparent fee structures and have a wide range of products to present to you.

When it comes to such an important decision, tapping into professional knowledge isn't just smart—it's essential. Your broker's experience could mean the difference between an okay deal and the best possible outcome for your circumstances.

Applying for a Mortgage

1. Preparing Your Financial Documents

Before diving into the mortgage application process, it's crucial to get your financial documents in order. Lenders will scrutinise your financial history to assess risk, making thorough preparation key to a smoother application process.

You'll need:

Proof of income, such as recent payslips or tax returns

Bank statements from the past few months

A list of assets, including savings and investment accounts

Full disclosure of debts, like credit card balances or loans

Your credit report to check for errors that could impact your application

Gather these documents early to expedite the application and provide lenders with confidence in your financial responsibility.’

2. Shopping Around for the Best Deal

It's not just about finding a mortgage; it's about finding the right mortgage for you. Interest rates and terms vary widely, so shopping around is essential.

Use comparison websites to get an overview of the market. But don't overlook the value of a personalised quote that considers your specific circumstances.

Approach multiple lenders, including:

High street banks

Credit unions

Online lenders

Specialty mortgage companies

Remember, the cheapest rate isn't always the best deal. Weigh up fees, flexibility, and other features that could impact your long-term finances.

3. Understanding the Application Process

Knowing what to expect can demystify the application process. After you've found a potential lender, you'll typically go through the following steps:

Initial enquiry: Discussing your financial situation and mortgage needs

Application submission: Completing forms and supplying documentation

Credit and affordability checks: Allowing the lender to evaluate your suitability

Valuation of the property: To ensure the loan won't exceed its worth

Some lenders provide a decision in principle (DIP) that indicates preliminary approval while the more detailed underwriting process is carried out.

4. What to Expect During the Approval Process

Finally, understanding the approval process can help you anticipate potential hiccups.

After submitting your application, the lender will conduct:

A thorough assessment of your financial background

An appraisal of the property to confirm its market value

A legal check on the property to identify any issues

Expect to answer additional questions and provide more documentation if requested. Loan approval times can vary, typically taking anywhere from a few days to several weeks.

During this time, maintain a stable financial situation and avoid new debts or major purchases that could alter your risk profile.

Stay in communication with your mortgage broker; they're your ally, guiding you through this process and helping to resolve any issues that may arise.

Frequently Asked Questions

1. What financial documents do I need to apply for a mortgage?

You will usually need your recent payslips, bank statements, tax returns, and proof of identity to apply for a mortgage. Different lenders may require additional documents.

2. How do I find the best mortgage deal?

Compare different lenders for interest rates, fees, and terms. Consider using a mortgage calculator or speaking to a mortgage broker to understand your options better.

3. What is the mortgage application process like?

The mortgage application process involves submitting your financial paperwork, undergoing a credit check, and an assessment of your financial history. Approval times can vary by lender.

4. How can potential hiccups in the mortgage process be anticipated?

Be prepared for potential challenges by keeping all your financial documents up to date, maintaining a good credit score, and saving for a solid down payment. Communicate openly with your lender or broker about any concerns.

5. Why is communication with my mortgage broker important?

Good communication ensures you’re informed about your application status and can promptly provide any additional information required. It also helps to manage expectations and resolve issues that may arise during the application process.

Conclusion

Navigating the mortgage landscape can seem daunting, but with the right guidance, you'll find the path that leads you home. Remember, preparation is key, and having your financial documents in order will smooth out the journey.

Don't hesitate to shop around – it's your right to secure the best deal possible. Trust in the process, keep open lines of communication with your mortgage broker, and you'll be well on your way to getting the keys to your dream home.

Stay patient, stay informed, and soon you'll step through the door of a property you can call your own.

This content is for informational purposes only and should not be construed as financial advice. Please consult a professional advisor for specific financial guidance.

Similar articles

April 23, 2025

Established fact that a reader will be distracted by the way readable content.

April 23, 2025

Established fact that a reader will be distracted by the way readable content.

April 16, 2025

Established fact that a reader will be distracted by the way readable content.